Scheme for settlement of overdue taxes by monthly installments

The Cyprus Tax Authorities issued an announcement where they give guidance regarding the implementation of the scheme.

Important aspects of the law/scheme:

1. Type of taxes covered under the scheme

a. Income Tax

b. Special Defence Contribution

c. Capital Gains Tax

d. Inheritance Tax

e. Immovable property tax

f. Special Contribution

g. Stamp Duty

h. VAT

2. Periods covered

a. All taxes due for the years up to and including 2015 which at the date of the application have been assessed by the Tax Department and appear as payable.

b. Amounts which become payable as a result of the submission of a self-assessment in respect of tax years up to and including 2015 where the tax returns for the relevant tax year have already been submitted, but no tax payment was made.

c. Tax liabilities which are assessed after 3 July 2017 by the Commissioner of Taxation and relate to tax years up to and including 2015. In this case, a separate application for regulation must be made within three months from the date on which the tax becomes due (i.e. on the basis of the tax assessment which will be issued).

3. Instalments and discounts

The overdue taxes will have to be paid in equal monthly instalments, the number of which does not exceed:

a. 54 monthly instalments for overdue taxes not exceeding €100.000, provided that each instalment is not less than €50;

b. 60 monthly instalments for overdue taxes exceeding €100.000, provided that each instalment is not less than €1.852

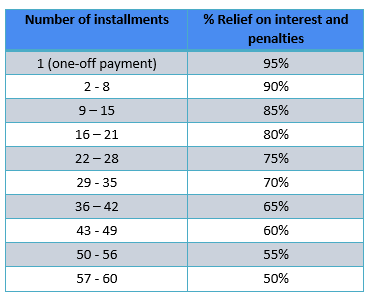

Based on the number of installments the relief from interest and penalties are as follows:

4. Procedure for the settlement of the overdue taxes

a. An application needs to be submitted to the Tax office through the government portal Ariadni. The individuals or companies interested in the scheme need to be registered first into the portal ( https://cge.cyprus.gov.cy/re/public/ ) to be able to apply for the scheme. The whole process (application and approval) will be done electronically through the platform.

b. For one off payments these can be done outside the portal through completing the form ΤΦ2005Ε/2017 and submission to the Tax office.

5. Termination of the scheme

The scheme will be automatically terminated for a tax payer in case that there is a:

a. failure to settle a liability that relates to a period after the 31st December 2015,

b. failure to file tax and VAT returns during the settlement scheme,

c. delay in payment of any 3 instalments,

d. delay in payment of an instalment for more than 3 consecutive months, including the month the instalment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Our tax specialists are at your disposal should you require any further information or clarifications.