Amendments of the Cyprus IP Box tax regime

The provisions of the Cyprus Tax law for the treatment of intangible assets have been amended on 14/08/2020, retrospectively from 01/01/2020.

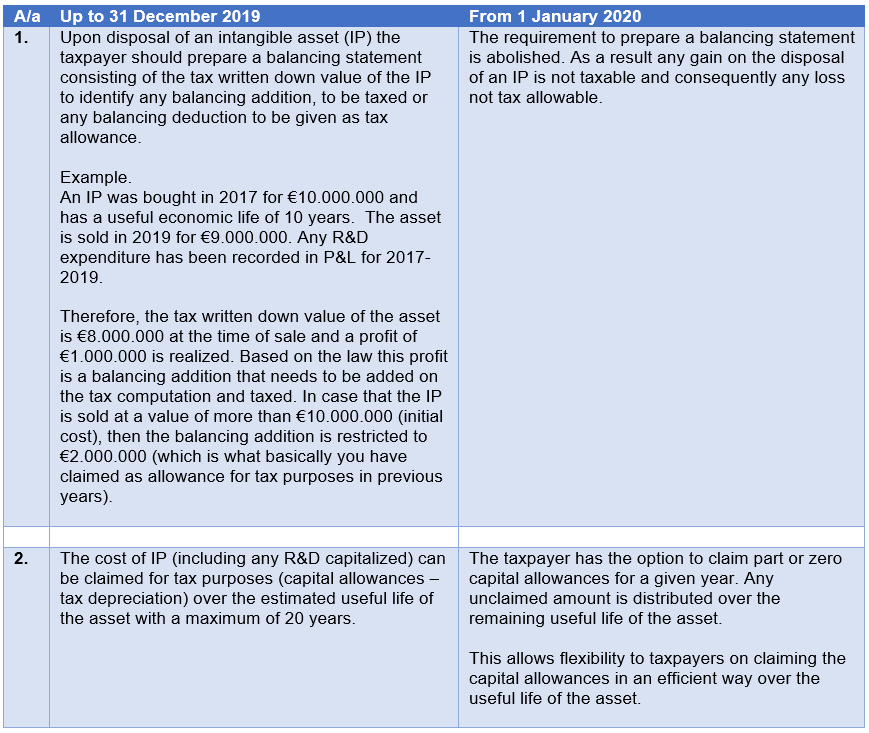

The amendments as explained below they enhance the attractiveness of the regime by:

- abolishing any tax on the gain realized on the disposal of the intangible assets (even on the capital allowances claimed as tax deduction) and;

- provide flexibility to taxpayers on the claim of capital allowances over the useful life of the intangible

An analysis of the amendments is presented as below:

The above amendments do not apply for IP assets existed up to 30/06/2016 and fall into the grandfathering provisions of the law that continue to apply up to 30/06/2021.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Our tax specialists are at your disposal should you require any further information or clarifications and for further advice on the subject matter.